idaho state income tax capital gains

Are capital gains taxed in Idaho. 3193 Additional State Capital Gains Tax Information for Idaho The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

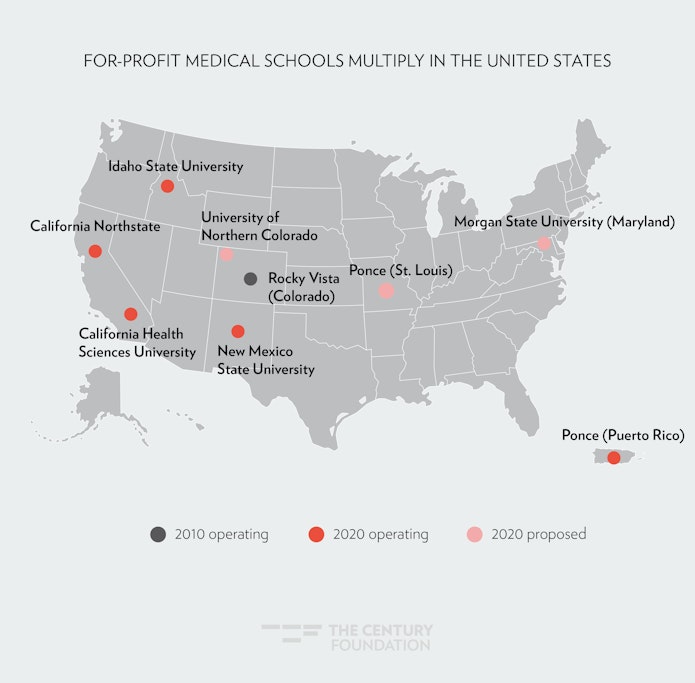

For Profit Medical Schools Once Banished Are Sneaking Back

The federal government taxes income generated by wealth such as capital gains at lower rates than wages and salaries from work.

. Passive Investing in Idaho Real Estate with Heather Dreves. If you are in the 396 bracket your long-term capital gains tax rate is 20. A capital gain rate of 15 will apply should your taxable income be at least 80000 but less than 441450 for single filers 496600 for married filing jointly or qualifying widower 469050 if you plan to file as head of household and 2483000 if you.

Box 36 Boise ID 83722-0410 Phone. We last updated Idaho FORM CG in January 2022 from the Idaho State Tax Commission. The capital gains deduction is sixty percent 60 or one thousand five hundred dollars 1500.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. This form is for income earned in tax year 2021 with tax returns due in April 2022.

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income. Idaho Capital Gains Tax. Idahos capital gains deduction Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

In Idaho the uppermost capital gains tax rate was 74 percent. A taxpayer recognizes a capital gain of twenty thousand dollars 20000 on the sale of Idaho real property that qualifies for the deduction. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income.

All of these special treatments any additional tax levied at the state or local level and the effect of the the prior average of 287 percent in 2014. You can also have a capital loss when you sell an asset like your house for less than what you paid for it. Capital gains are taxable at both the federal and state levels.

Idahos maximum marginal income tax rate is the 1st highest in the United States ranking directly. As mentioned this can be a short-term or long-term gain and you need to report it on your income tax return to the IRS. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more information on this rule.

However taking into account each states respective capital gains income the weighted average rate is 289 percent. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property. The rate reaches 693.

The combined uppermost federal and state tax rates totaled 294 percent ranking tenth highest in the nation. Taxpayers with adjusted gross incomes above 250000 filing jointly or 200000 filing individually may be subject to an additional 38 Medicare tax on investment income as a result of the Patient Protection and Affordable Care Act. Idaho residents must file if their gross income for 2021 is at least.

However certain types of capital gains qualify for a deduction. 208 334-7846 taxreptaxidahogov httpstaxidahogov. Additional State Income Tax Information for Idaho.

Taxes capital gains as income and the rate reaches 66. Capital gains for farms is complicated. A state capital gains tax has been a hot topic for years ever since Democrats started talking about it as a way to raise money for key state services while helping fix what t.

208 334-7660 or 800 972-7660 Fax. Capital gains are taxed as regular income in Idaho and subject to the personal income tax rates outlined above. File Now with TurboTax.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Long-term capital gains come from assets held for over a year. Taxes capital gains as income and the rate reaches 575.

Taxes capital gains as income and the rate is a flat rate of 495. Form 40 is the Idaho income tax return for Idaho residents. Single age 65 or older.

2113601 - and above. Idaho axes capital gains as income. We will update this page with a new version of the form for 2023 as soon as it is made available by the Idaho government.

Instructions are in a separate file. Some States Have Tax Preferences for Capital Gains. The highest-income taxpayers pay 408 percent on income from work but only 238 percent on capital gains and stock dividends.

Single under age 65. Because this is a farm it is impossible forme to figure the actual exact tax rate for this sale. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

The capital gains rate for Idaho is. Based on filing status and taxable income long-term capital gains. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income.

In Idaho the uppermost capital gains tax rate was 74 percent. By Brett Mar 25 2022 Capital Gains Tax Solutions Podcast Brett Mar 25 2022 Capital Gains Tax Solutions Podcast. Short-term capital gains come from assets held for under a year.

Idaho home sellers need to understand how these rate limits on capital gains taxes will affect their investment. Real property that is held for at least one year is eligible for a deduction of 60 of the net capital income that is the net gain after expenses. Taxes capital gains as income and the rate is a flat rate of 323.

The percentage is between 16 and 78 depending on the actual capital gain. Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Married filing separately any age.

Idaho State Personal Income Tax Rates and Thresholds in 2022. In Idaho capital gains happen when you sell an asset such as a house for more than what you paid for it. State Tax Commission PO.

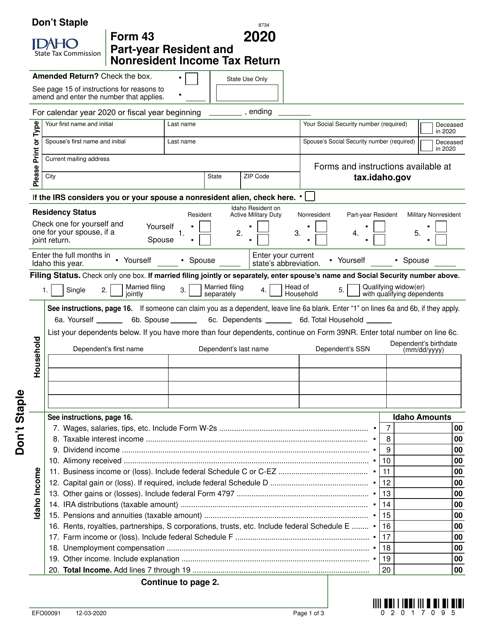

Idaho State Tax Commission Templateroller

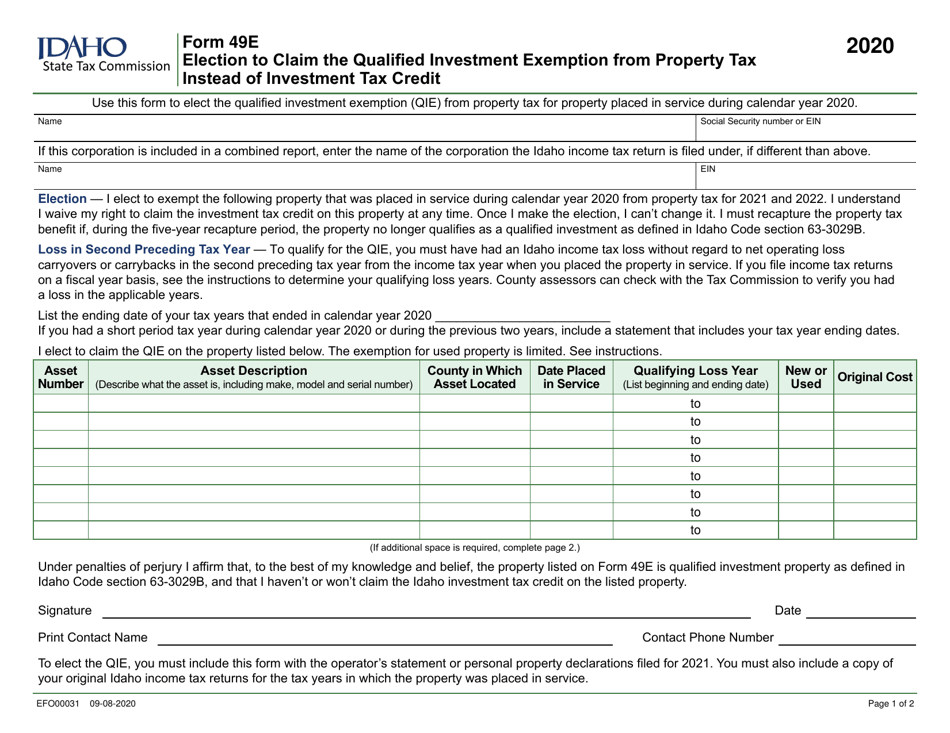

Form 49e Efo00031 Download Fillable Pdf Or Fill Online Election To Claim The Qualified Investment Exemption From Property Tax Instead Of Investment Tax Credit 2020 Idaho Templateroller

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Guide To Combined Reporting Idaho State Tax Commission

Guide To Combined Reporting Idaho State Tax Commission

Idaho Income Tax Calculator Smartasset

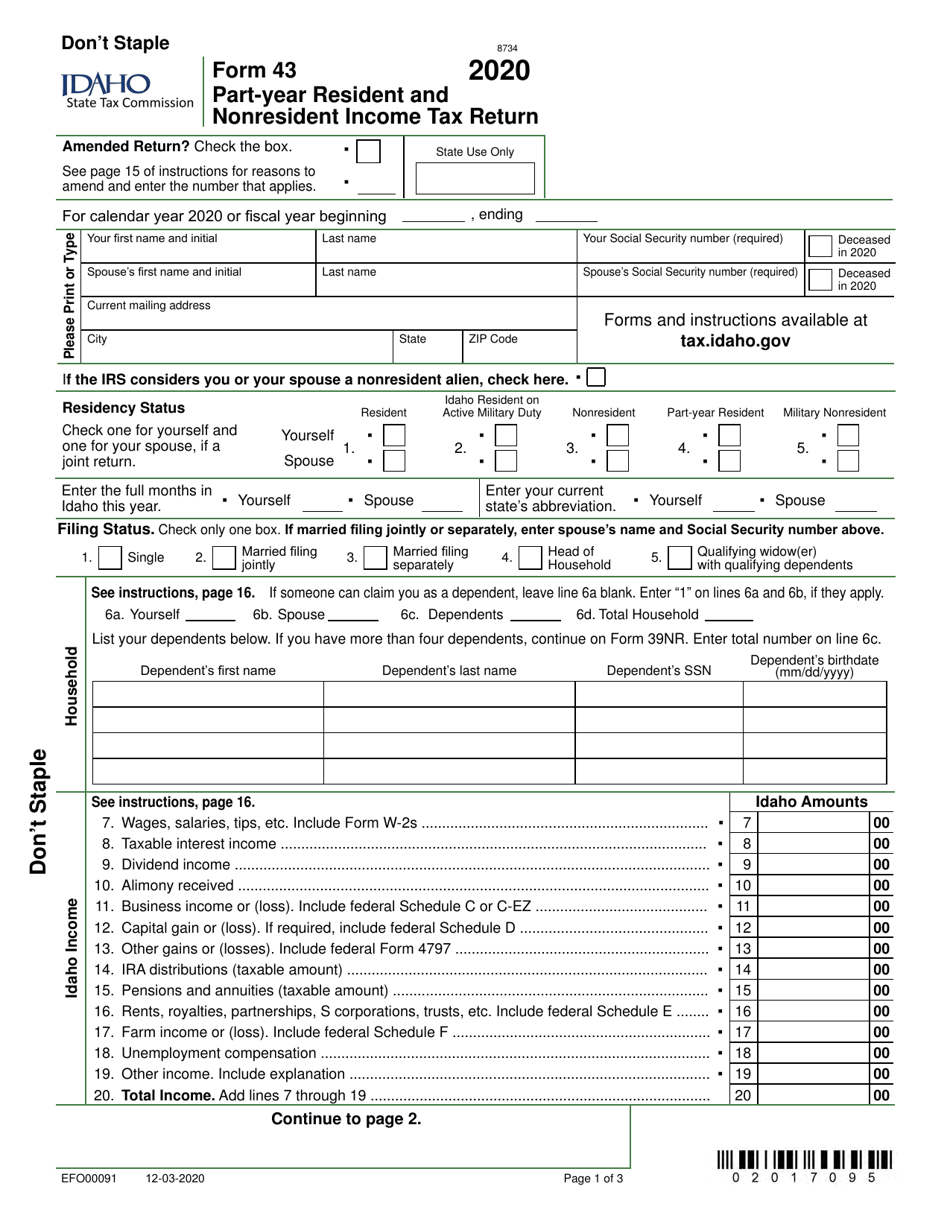

Form 43 Efo00091 Download Fillable Pdf Or Fill Online Part Year Resident And Nonresident Income Tax Return 2020 Idaho Templateroller

Idaho Tax Forms And Instructions For 2021 Form 40

Idaho Income Tax Brackets 2020

Claim Your Grocery Credit Refund Even If You Don T Earn Enough To File Income Taxes Idaho Bigcountrynewsconnection Com

Form 43 Efo00091 Download Fillable Pdf Or Fill Online Part Year Resident And Nonresident Income Tax Return 2020 Idaho Templateroller

24193 Idaho State Tax Commission

Guide To Combined Reporting Idaho State Tax Commission

Historical Idaho Tax Policy Information Ballotpedia

Idaho Income Tax Calculator Smartasset

Idaho State Tax Software Preparation And E File On Freetaxusa

24193 Idaho State Tax Commission

Prepare And E File 2021 Idaho State Individual Income Tax Return